Revealed: UK’s most expensive places to insure your motorbike

Our research has revealed the most expensive places to insure your motorbike in the UK.

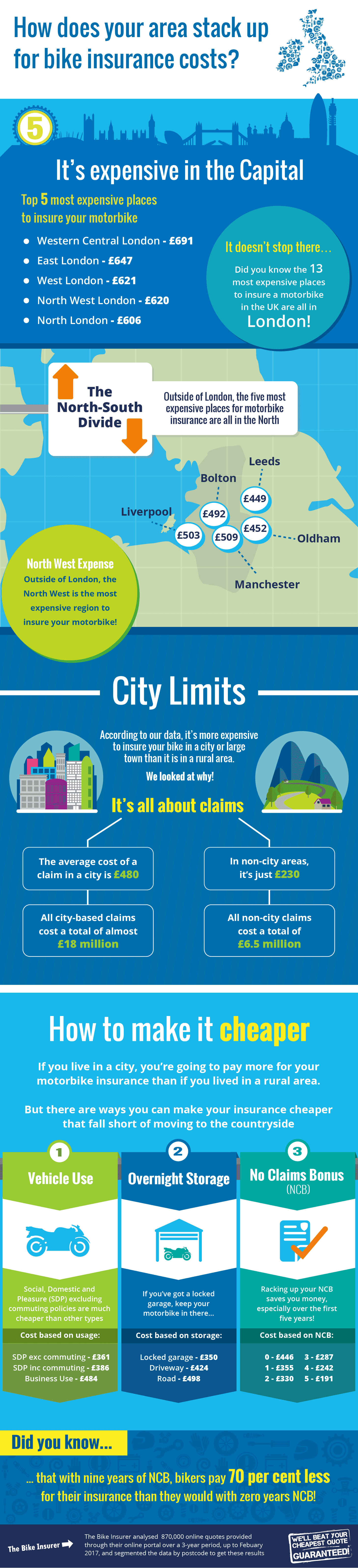

We analysed around 900,000 quotes generated through The Bike Insurer by genuine customers over a three year period to discover, a little unsurprisingly, that quotes in Central London are the most expensive in the UK.

In fact, London accounts for the 13 most expensive places to insure your motorbike in the UK, peaking in Western Central London where premiums cost £691 on average between January 2014 and February 2017.

North West costs

Outside of the UK's capital, it's the North West that's the most expensive place to insure a motorbike, with the likes of Manchester, Liverpool, Bolton and Oldham all more expensive than the likes of Birmingham, Edinburgh and Cardiff.

Outside of London, it's only Manchester (£509) and Liverpool (£503) who pay more than £500 on average per premium, while Bolton and Oldham aren't far behind with average premium costs of £492 and £449 respectively.

Big city bias

Our research revealed that motorcycle insurance is most expensive in big cities and, it's noticeably cheaper in rural areas.

What was surprising was why this was the case because it wasn't the result of increased rates of accidents or thefts, as you might expect within urban areas.

Instead it was down to the cost of claims in cities where they cost £18m in cities versus around £6.5m in rural areas.

Jon Morrell, CEO at The Bike Insurer, said: "We were actually surprised at what the data showed us because we expected higher claim rates in cities than in rural areas because of higher theft rates.

"What we actually found was that the number of claims per quote was the same in cities and in rural areas, despite much higher rates of theft in urban areas. The big difference was the cost of claims themselves; in cities they were more than double the cost of claims in non-city areas.

"What we can take from this is that claims for bikes damaged in accidents are obviously much cheaper than claims for total loss following theft, where insurers will have to foot the bill of replacing a full motorcycle rather than just parts and repairs."

How to keep the cost of motorbike insurance down?

Rather than upping sticks and moving to the countryside, there are some simpler ways for bikers to save money on their motorcycle insurance.

According to our data, going with a Social Domestic and Pleasure (SDP) policy which excludes commuting is the cheapest way to insurance, costing just £361 on average compared to £386 average for SDP including commuting and the £484 average cost of a Business Use policy.

Similarly, keeping your motorbike in a locked garage overnight results in average premiums of £350, compared to £424 when bikes are stored on driveways and £498 when kept on the road.

No Claims Bonus (NCB) unsurprisingly has a big impact on the cost of your insurance with just one year's NCB slashing costs by around 21 per cent compared to a rider with zero NCB.

See how much you can save

Compare quotes from 37 insurers